SEARCH HISTORY

Vivian Tu of @YourRichBFF Gives Us the Skinny on Trump’s Tariffs

If you’re just dipping your toes into the frigid waters of personal finance, @YourRichBFF is an excellent place to start. Vivian Tu, the savvy woman behind the viral Instagram account, has made the inscrutable world of Wall Street feel a bit more accessible. Raised by immigrant parents, Tu quickly learned the importance of hard work and financial discipline, later becoming the only woman on her trading team at JP Morgan (aside from her boss). After identifying a widespread crisis of financial illiteracy, she launched @YourRichBFF to demystify money once and for all. Since then, she’s built a community of over three-million Instagram followers and published her first book, Rich AF. And in today’s climate, as we edge closer to a trade war that threatens to disrupt the global economy, Tu has become Gen-Z’s trusted financial guide, advising her followers on everything from opening brokerage accounts to first-time investments. Days after the President announced tariffs on as many as 90 countries, we caught up with @YourRichBFF via DM to help us make sense of it all.

———

CLARA SCHOLL: A/S/L?

VIVIAN TU: Oooh millennial throwback! 31/F/NYC.

SCHOLL: Tell me, are we about to enter a recession?

TU: HAHAHA. Oh I’m glad we’re starting with an easy one. Short answer: maybe. Technically we are not *currently* in a recession, because it’s defined as two consecutive quarters of negative economic growth. But given some of the recent uncertainty from policy changes, I wouldn’t be surprised if we do end up in one. That said, recessions are a normal part of the boom-bust business cycle. They’re not this crazy “sky is falling” thing.

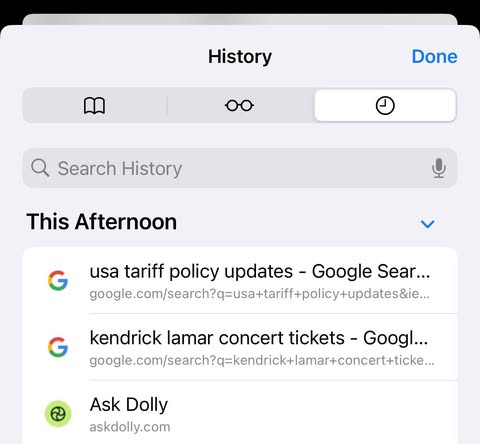

SCHOLL: What were your last three Google searches?

TU: Yes tariffs, but also yes Sza and Kendrick.

SCHOLL: What’s the strangest DM you’ve ever received?

TU: Hands down the time a BFF asked me for feet pics. Worst part was he lowballed me. $80 for these lil piggies! Can you believe?

SCHOLL: Adding insult to injury. What’s the first thing you do when you wake up?

TU: I have very bad eyes. -7 prescription in both. So first thing is probably pat pat pat around my nightstand for my glasses

SCHOLL: As a fellow New Yorker, what’s the best meal in NYC for under ten dollars?

TU: EAAAASY. Wah Fung No. 1 Fast Food. They serve a bunch of proteins (char siu pork, crispy duck, roasted chicken) with some nice sautéed cabbage, fluffy white rice, and they’ll even top it off with some of the sauce from the meats. Usually comes in around $8!

SCHOLL: Where do you spend most of your time online?

TU: Instagram Reels like a true millennial.

SCHOLL: What is success to you?

TU: It’s definitely changed over time. It used to be designer bags, fancy dinners, and social media worthy trips. But these days, success to me is just having options. The option to take an Uber home instead of the subway if it’s too late. The option to WFH if I’m not feeling well. The option to do what I want with my time, because I have the foundation to support me, so I don’t have to make decisions out of a place of scarcity or need.

SCHOLL: Whose face do you want to see on American currency?

TU: I mean, I’d love to call dibs when we bring back the $500 dollar bill. I’ll have my headshot ready!

SCHOLL: What’s the best investment strategy for someone in their 20s?

TU: Use time to make you money. When you’re in your 20s, you’ve got plenty of time, but likely less money than during later decades. I’d say put what you can afford to set aside into a diversified portfolio of index funds or a target date retirement fund (associated with the year you turn 65) and then let time do its thing. Set it and forget it.

SCHOLL: What’s a worse investment: Trump Coin or Art NFTs?

TU: Personally, you wouldn’t catch me investing in either. Neither have any real utility. They’re only worth what people are willing to pay for them. It’s like buying hype.

SCHOLL: How should one split their income between saving, investing and spending?

TU: Personal finance is personal, but a great jumping off point would be 50% of your take home pay to needs, 30% to wants, and 20% to taking care of future you (saving, debt paydown, investing). That said, over time, the hope is that the 20% piece becomes a larger and larger percentage while the 50 and 30 categories get smaller as your income increases!

SCHOLL: Real talk, will I ever be able to buy a home?

TU: Do you actually want a home or do you feel the pressure to buy because society tells you that you *should*? Fun fact: it’s actually cheaper to rent than buy in all 50 of the largest US metros right now!

SCHOLL: How do you see climate change affecting the future of finance/investment?

TU: It’s so interesting that you should ask that because climate change and money are so intimately linked. My biggest concern is the insurance industry. There’s this big open secret that a lot of areas are underinsured — AKA insurance companies can’t make money in those geographies, so they just up and leave the area entirely. As climate change causes the frequency and severity of natural disasters to increase, more and more people will be at risk of losing their livelihoods and most expensive possessions if something bad occurs. Climate change is real and whether or not people believe in it, insurance companies certainly do.

SCHOLL: How do you know you’re in the presence of a real rich BFF?

TU: Oh, I love this question! Real rich BFFs want richness for their friends! They don’t gatekeep, they love to pass along tips and tricks, and most importantly, they know it’s cool to talk about money.

SCHOLL: Can you send us a screenshot of your stock portfolio?

TU: HAHAHA.

SCHOLL: In 20 words or less, explain the tariffs to our financially illiterate readers.

TU: Tariffs are a tax that Americans would pay on imported goods. They’re largely used as a negotiation tool and protectionist measure to make home-grown products more appealing. However, the implementation of tariffs rolled out by this administration has pretty much been a wrecking ball to global trade and has left both Americans and other countries feeling uncertain. The biggest issue is the fact that they’re on again off again, which will be an issue for the supply chain. Kind of like a bad boyfriend.

SCHOLL: Safe to say the worst boyfriend ever. Do you foresee any unexpected impacts of these tariffs on everyday Americans?

TU: 1) Even if you aren’t buying NEW stuff, costs for stuff you already have are gonna go up. It always comes back to insurance lmfao. But what do you think happens when every car accident claim asks for more money because windshields cost more money to replace? Your premiums are gonna go up. 2) Even “American made” brands are gonna get more expensive. Say you wanna buy Florida oranges that are grown in America, but the hose used to water the oranges isn’t. Neither is the truck that drives them from farm to factory. Neither are the lightbulbs used in the grocery store. Nor is the netting that holds them in a convenient package. When there are more costs throughout the supply chain, we’ll just end up paying more for stuff!

SCHOLL: Can you share your favorite tariff meme?

SCHOLL: Are we doomed?

TU: No more than usual, but I do think it’s high time we all splash ourselves with some cold water and realize that we hold the pen when writing our own stories. If you’re feeling doomed, assess why you might feel that way and change the plot line!